The Christmas Forex Paradox

Christmas in the forex market is a strange time of year. While most people are wrapping presents, eating their bodyweight in chocolate, and pretending to enjoy office parties, traders are staring at charts that suddenly look… well, half asleep. Banks are closed, institutional desks are running on skeleton crews, and the big liquidity providers are off somewhere skiing, yet the forex market stubbornly refuses to take a holiday.

The end result? A market that’s technically open but operating on fumes. Price action slows down, spreads widen, and even the most well-behaved pairs can start acting like they’ve had one too many mulled wines. For new traders, this can be confusing. For experienced traders, it’s simply “Ah yes, it’s Christmas again.”

But here’s the twist: although liquidity drops sharply during the Christmas period, the conditions create unique opportunities for traders who understand what’s happening behind the scenes. When volume disappears, price often behaves differently, slower at times, erratic at others, and if you know how to read these thin markets, you can take advantage of setups that don’t typically appear during the rest of the year.

In this article, we’re going to explore exactly why the Christmas period is different, what price action usually looks like, and how you can navigate, and profit from, these holiday markets without blowing your account while everyone else is watching It’s a Wonderful Life or Home Alone.

What Low Liquidity Means in Forex

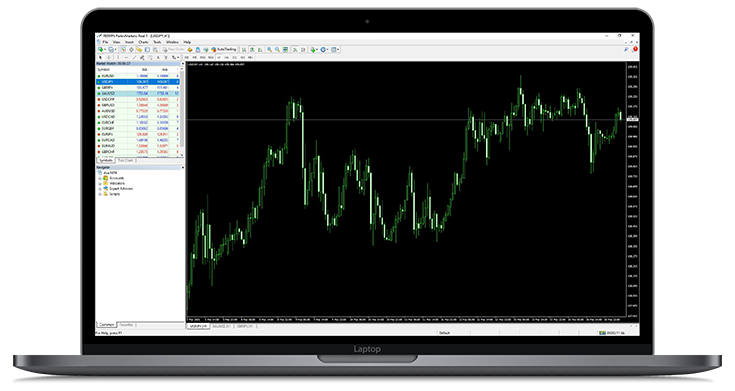

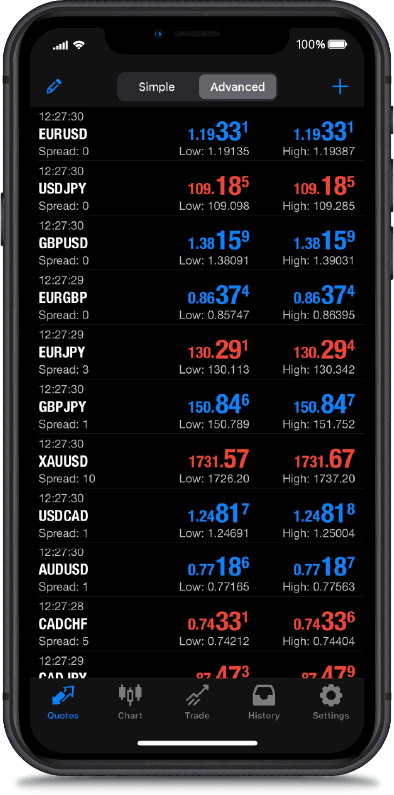

In forex trading, liquidity refers to how easily a currency pair can be bought or sold without dramatically changing its price. During normal market conditions, the major pairs, EUR/USD, GBP/USD, USD/JPY, are incredibly liquid because banks, hedge funds, institutions, and algo desks are constantly pouring orders into the market. Think of it like a busy motorway: high traffic, lots of movement, and everything flows smoothly.

But during the Christmas period, that motorway becomes an empty road at 3 a.m.

Most banks are closed. Institutional traders are already on holiday. Market makers reduce their activity. That means there are fewer buy and sell orders, so every price movement has more impact than usual. The core principle is simple: when liquidity falls, volatility behaves differently, sometimes shrinking into slow, sleepy ranges, and other times snapping into sharp spikes because even small orders can shove price around.

Low liquidity also affects practical trading conditions:

● Spreads widen, especially on minors and exotics.

● Orders may fill differently, creating slippage.

● Breakouts often fail, because there’s no volume to sustain them.

● Price reacts more dramatically to smaller inputs, giving the chart an unpredictable holiday personality.

It’s important because understanding liquidity helps traders avoid overreacting to strange Christmas movements. What looks like “the start of a major trend” may simply be the market’s version of drifting off after too much turkey.

Yet, despite the quirks, this environment can be incredibly profitable if you know how to adapt, and that’s what we’ll explore next.

Typical Christmas Price Action: Calm Seas… with the Occasional Rogue Wave

If you’ve ever watched the charts during Christmas week, you’ll know the price action has a very particular vibe. In normal market conditions, forex behaves like a busy marketplace, noise, movement, energy. But during Christmas? It’s more like a quiet village pub just before last call. Things slow down… until someone slams the door and everything jumps.

In forex trading, holiday price action tends to fall into two distinct behaviours: calm ranges and random spikes, sometimes switching between them with no warning whatsoever.

1. The Classic Holiday Range (a.k.a. “The Market Has Given Up”)

Because liquidity is thin, price often moves sideways in tight consolidation zones.

● Breakouts stall.

● Trends pause.

● Volatility drops to the level of a Sunday afternoon nap.

This can frustrate traders expecting big moves, but it’s fantastic for traders who know how to range-trade and look for predictable bounce points.

2. Sudden Sharp Spikes (a.k.a. “Who Just Pressed That Button?”)

Here’s the fun part: with so few participants in the market, it doesn’t take much to cause a large candle. A small institutional order, an algo hiccup, or even a late year rebalance can shove the price several dozen pips in seconds.

These rogue-wave spikes are common around:

● low-volume sessions

● thin order books

● unexpected news releases

● market opens and closes during holiday hours

They look dramatic on the chart, but they often fade quickly because there isn’t enough follow-through to carry them into sustained trends.

3. False Breakouts Everywhere

Christmas markets are a playground for fakeouts. Price pokes out of a range, catches traders sleeping, triggers stops… and then snaps right back inside like nothing happened. This happens because breakouts rely on volume, and during the holidays, volume simply isn’t there.

4. Liquidity Gaps and Strange Candle Wicks

You’ll often see:

● unusually long wicks

● candles that form too quickly

● uncharacteristic jumps between prices

This isn’t “market manipulation”, it’s just what happens when there aren’t enough resting orders on the book to absorb sudden buying or selling pressure. In short: Christmas price action is a blend of sleepy sideways movement and random bursts of chaos.

Why Markets Still Move Even When Everyone Is on Holiday

You’d think that if banks are closed, institutional traders are on ski trips, and retail traders are too busy eating mince pies, the forex market would simply lie down and take a nap. But surprisingly, the charts still move, sometimes more dramatically than expected. Why?

Because reduced participation doesn’t mean zero participation. And the traders (and algorithms) who remain active over Christmas can still create meaningful price shifts. Here’s what keeps the market alive during the holiday lull:

1. Algorithms Never Take a Holiday

In forex trading, algorithmic trading refers to automated systems executing trades based on preset rules. Unlike humans, algos don’t care about Christmas, office parties, or family gatherings. They simply run 24/7, following their instructions.

Examples of algos that stay active:

● arbitrage algorithms

● trend-following bots

● liquidity-provision modelsWith fewer humans trading, algorithms have more influence, meaning even minor signals can create outsized moves.

2. News Releases Still Happen

Just because Santa’s coming doesn’t mean economic data stops. Things like: ● inflation reports ● GDP data ● central bank speeches ● employment numbers...can drop right in the middle of low-volume conditions, causing exaggerated reactions. A news candle that would normally move 20 pips can suddenly move 80 pips simply because there’s no liquidity to absorb it.

3. Year-End Position Adjustments

Every December, funds and institutions rebalance portfolios for:

● performance reporting

● tax efficiency

● risk management

● window dressingThese adjustments can cause sudden flows in major currency pairs… even if the desks operating them are on skeleton crew. This is one reason why you’ll often see surprise strength or weakness leading into year-end, it’s not “Santa rally magic.” It’s institutional bookkeeping.

4. The Thin Order Book Effect

The core principle is simple: When fewer orders sit in the book, price moves further with less effort. Think of price as a car rolling down a hill. Normally it hits traffic (order volume) and slows down. But during Christmas? The road is empty, so even a small push can send it flying.This explains:● long wicks● sudden reversals● outsized movements during typically quiet sessions.

5. Retail Traders Are Still Active

New traders love the idea of “free time over the holidays = more time to trade.” But without real liquidity, retail activity can distort price slightly more than usual. Retail alone can’t move the market much……but in December, their activity becomes more noticeable.

The Christmas Trading Opportunities Nobody Talks About

Most traders avoid the markets during Christmas because the low liquidity feels unpredictable. But hidden inside the sleepy December charts are some of the cleanest, most reliable trading opportunities you’ll see all year.

A) Range Trading: The Holiday Gift That Keeps on Giving

In forex trading, the term range refers to price bouncing repeatedly between support and resistance levels. During Christmas, ranges appear everywhere - and they behave beautifully.

Why Christmas ranges work so well:● Low liquidity = fewer trend drives● Institutions aren’t there to force strong directional moves● Price “wanders” between the same levels for days● Breakouts tend to fail (which makes the range even stronger)

How to trade Christmas ranges:● Mark the top and bottom of the range● Look for rejection wicks or engulfing candles● Enter near the edges, not the middle● Keep stops conservative but sensible● Take profits earlier than usual

The market isn’t trying to trend. It’s simply bouncing, and if you embrace the boredom, the setups are surprisingly reliable.

Example: EUR/USD might spend three days drifting between 1.0930 and 1.0970, offering multiple low-risk entries from both sides. It's not thrilling… but profitable doesn’t always look exciting.

B) Fade the Fakeout: Turn Low Liquidity Against the Market

In trading, a fakeout happens when price briefly breaks a key level before snapping back inside. During Christmas, fakeouts are almost guaranteed because breakouts need volume, and there isn’t any.

These fakeouts are essentially the market whispering: “Relax… I’m not actually going anywhere.”

How to capitalise on fakeouts:

● Identify major levels: range highs, range lows, daily structure

● Wait for a breakout candle that doesn’t show follow-through

● Enter IN THE OPPOSITE direction once price reclaims the level

● Target the opposite side of the range

This strategy works beautifully during the holidays because thin order books exaggerate moves that can’t sustain themselves.

Why this works: In low liquidity, a handful of orders can push price above a key level. But when no new buyers join the move, the breakout collapses almost instantly.

C) The Rare Breakout That Actually Means Something

Most holiday breakouts fail, but when one holds, it can create a powerful multi-day move. These are the breakouts that institutional traders often call “quiet accumulation” or “stealth repositioning.”

Clues you’re seeing a genuine breakout:

● It happens near major end-of-year levels

● The candle CLOSES strongly beyond structure

● Pullbacks are shallow or non-existent

● Volume (if your broker shows it) increases slightly

● The next session respects the breakout level

Why these breakouts matter: Institutions sometimes quietly reposition for Q1 during the low-liquidity period, because it allows them to move size with less market impact. So when a real breakout holds, it can mark the beginning of January’s major trend.

How to trade it:

● Enter on the retest if it comes

● Or scale into the move using smaller position sizes

● Hold for multiple sessions - Christmas trends unfold slowly

These moves don’t happen every year… But when they do, they are some of the cleanest trades traders catch all winter.

As a result: Christmas isn’t just a quiet market. It’s a different market, and if you stop expecting normal price action and start embracing what December specialises in, there are plenty of opportunities hiding in plain sight.

Risk Management: The Holiday Edition

In forex trading, risk management refers to the methods traders use to protect their capital and control the impact of losing trades. During Christmas, risk management becomes even more important because the market doesn’t behave in its usual structured way. Think of it like driving on an icy road, you can still get where you’re going, but you need to adjust your speed, your expectations, and your grip on the steering wheel.

Here’s how to protect yourself (and your account) during the festive low-liquidity season.

1. Use Smaller Position Sizes (the smart approach)

Low liquidity = bigger, faster spikes. Meaning? Your normal lot size might suddenly feel about three sizes too large.

A smaller position helps you:

● survive unexpected volatility

● stay calm during surprise wicks

● avoid blowing your account because the market hiccupped

It’s simple: when the market thins out, so should your position size.

2. Expect Wider Spreads, and Plan for Them

Spreads naturally widen during holidays because fewer liquidity providers are online. This means:

● stop-losses may trigger sooner

● break-even moves might slip into losses

● entries could cost more than usual

If you normally use tight stops, you might need to give price a little extra breathing room. Not too much, just enough so you’re not stopped out by a spread that resembles a Christmas jumper: wider than you expected.

3. Don’t Chase Every Move (December is full of traps)

In low liquidity, every spike looks meaningful… but most aren’t. They’re just thin-market noise. Avoid:

● impulsive trades

● chasing candles

● entering because “it might be the start of a trend”

During Christmas, patience beats bravado every time.

4. Take Profits Earlier Than Usual

Christmas ranges are reliable, but they’re also tight. Holding runners forever rarely works because:

● price doesn’t trend well

● volatility is inconsistent

● reversals are common

Take partials or close your full trade at logical levels. Treat it like a seasonal sale, get in, get your profit, get out.

5. Be Extra Careful With Breakouts

Breakouts in December behave like New Year’s resolutions: They start strong, but most fail quickly.

Only trade breakouts that show clear commitment:

solid candle closes

strong structure shifts

no immediate wick rejections

If price looks unsure… assume it’s a fake out until proven otherwise.

6. Know When Not to Trade

This might be the most important part of holiday risk management.

Some days, especially around Christmas Eve, Christmas Day, and the period between Boxing Day and New Year’s, simply aren’t worth trading. Conditions are too thin, too unpredictable, or too sluggish. Most markets and brokers take the day off altogether.

And if you’re sat at the charts on Christmas Day? We need to have a long chat about life choices!

The bottom line: Christmas markets can be profitable, but only if you approach them with caution, smaller size, and a willingness to take what the market gives, not what you wish it would give.

Should You Even Trade During Christmas? (Honest Answer…)

Here’s the truth many traders don’t like to hear: You don’t have to trade during Christmas. The market will still be here after the turkey, after the family arguments, and after you promise for the tenth time that you’re not checking charts, “just replying to a message.”

But let’s break it down properly.

In forex trading, choosing when to trade is just as important as choosing what to trade. And the Christmas period is a perfect example of a time when the market conditions are so unusual that traders need to ask themselves a simple but important question:

“Is this worth it?”

Sometimes yes. Sometimes no. Below is my honest breakdown.

The Pros of Trading During Christmas

1. Clean, predictable rangesIf you enjoy range trading, December is a dream. Price often drifts back and forth between the same levels like it’s stuck on a loop, easy to map, easy to anticipate.

2. Opportunities from sloppy fakeoutsThin liquidity causes breakouts to behave terribly……and that’s good news if you understand how to fade them. These setups don’t always happen during normal market conditions, so Christmas can actually be a goldmine for patient traders.

3. Rare breakouts that start major January trendsCatch one of these and you’ll feel like you’ve been gifted the financial equivalent of a Christmas bonus.

4. Less market noiseBecause fewer players are active, charts can be surprisingly “clean.” Not always slow, but cleaner.

The Cons of Trading During Christmas

1. Spreads are wider than Santa’s beltEspecially at rollover, session opens, and during low-volume hours. If you like cheap entries, December may test your patience.

2. Random spikes can ruin good setupsYour perfect technical analysis might get wrecked by a single rogue candle that wouldn’t exist in normal liquidity.

3. Breakouts love to failIf you’re a breakout trader, Christmas might feel like a personal attack.

4. The temptation to overtrade out of boredomThis is a big one. With quiet markets, traders often force trades, a dangerous habit that usually leads to losing streaks.

So… Should You Trade?

Here’s the balanced answer:

Trade during Christmas if…

● you enjoy range trading

● you have discipline and patience

● you reduce your position size

● you know how to manage wider spreads

● you treat it like a different market environment

Avoid trading during Christmas if…

● you can’t resist overtrading

● you rely heavily on volatility

● you hate fakeouts

● you’re a breakout-only trader

● you’re supposed to be spending time with your family

There’s absolutely nothing wrong with taking a complete break. In fact, some of the best traders shut everything down, reset, and prepare for January, one of the strongest trading months of the year.

The honest truth: Christmas trading isn’t bad… it’s just different. Some traders thrive in it. Others struggle. The key is knowing which type you are and never treating the December market like a normal one.

The Final Takeaway: Santa Doesn’t Hate Forex Traders

By the time Christmas rolls around, many traders assume the market has packed its bags, switched on “Out of Office,” and left us with charts that look like they’re running on 10% battery. But the truth is far more interesting.

The Christmas period isn’t a dead market; it’s a different market. The rules change. The behaviour changes. The opportunities change. And once you understand the rhythm of low-liquidity conditions, the festive season becomes far less mysterious… and far more tradable.

Here’s what you should walk away with:

1. Low liquidity is both a challenge and an opportunityYes, spreads widen. Yes, you’ll see the occasional spike that seems personally offended by your stop-loss placement. But this environment also creates clean ranges, beautiful fakeout setups, and the occasional trend that kicks off the new year.

2. Christmas price action is predictable, in its own unpredictable wayIt’s like knowing your car will start slowly on a cold morning, or your family will argue about something irrelevant at Christmas dinner. You don’t know the exact details……but you know it’s coming.

3. Adaptation is everythingReduce size. Take profits earlier. Stay patient. Treat the market with the respect a low-liquidity environment demands. If you do that, Christmas becomes far less dangerous and far more strategic.

4. Taking a break is also a valid strategySome of the best traders in the world simply close their platforms and recharge. No charts, no entries, no stress… just a clean mental reset before January’s big moves start. There’s absolutely no shame in that. I rarely trade the Christmas period; my wife has too many jobs lined up for me to do!

My Final Word

Forex doesn’t stop for Christmas, it just behaves differently. If you’re prepared, disciplined, and willing to adapt, you can trade the holiday period with confidence instead of confusion. And who knows? You might even find a festive setup or two that pays for your Christmas dinner.

But remember: Santa isn’t against you. He just prefers traders who don’t blow their accounts on Christmas Eve.

Have a great Christmas everyone!