In the crazy world of forex trading, charts move, prices fluctuate, spreads widen, but the greatest volatility of all is what goes on inside the trader’s mind. You have just promised yourself “This is my last trade of the day” only to open five more because “the market looks seriously interesting,” congratulations - you’ve already met the psychological side of trading.

Forex psychology isn’t about indicators or economic reports. It’s about us - the fragile, hopeful, occasionally delusional human pressing the Buy/Sell button. On paper, trading seems simple: identify trend, enter trade, take profit. But in practice, it’s more like identify trend, doubt self, enter late, panic, close early, watch price go exactly where you intended, question your life choices.

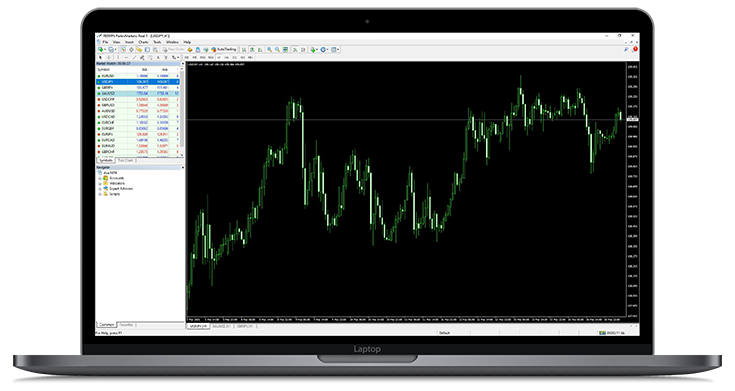

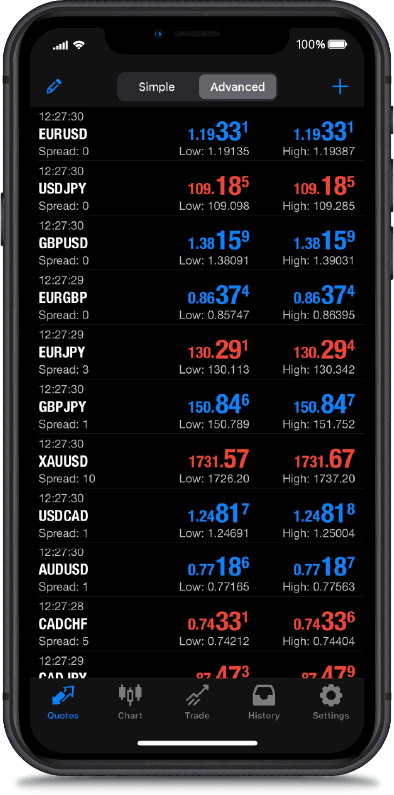

The markets have a way of showing us not just how money moves, but how we think, react, fear, and hope. Some traders succeed. Others rage-quit, delete MetaTrader, only to reinstall it an hour later. Why? The answer lies not in the candlesticks, but in the psychology behind the clicks.

In this article, we’ll dive deep into the trading mind - why some traders thrive while others surrender, why forex attracts such “interesting” personalities, and how mastering psychology can be a greater edge than any indicator ever could. Expect the hard truths, light humour, and a healthy reminder that it’s not just the market we’re fighting it is ourselves.

Who Gets Into Forex Trading (and Why They Should Probably Sit Down)

Forex trading doesn’t attract average people. No one casually stumbles into trading the world’s largest financial market the way they might take up gardening or knitting. No, forex attracts a very special breed - the financially optimistic, the freedom chasers, the strategy worshippers, and occasionally, the adrenaline junkies disguised as “investors.”

Let’s meet the common trader species that wander into the charts:

1 - The Dreamer – “I’ll Be a Millionaire by Christmas”

They discovered forex through a YouTube ad featuring a Lamborghini and someone saying, *“I turned $200 into $200,000.”*They haven’t learned risk management, but they have picked out a new villa in Dubai. Their favourite phrase? “Once I triple this account…” This trader often quits after the third margin call, only to return later with a renewed mindset: “This time I’m really serious.”

3 - The Strategist – “According to My 97-Page Trading Plan…”

They have folders, spreadsheets, colour-coded journals, and possibly a trading desk that belongs at NASA. They say things like, “I don’t trade with emotion,” seconds before rewriting their plan after one losing day. While disciplined, they often forget to actually trade, spending four hours analysing and zero minutes executing.

3 - The Gambler – “All In, or Nothing Happens!”

To them, forex isn’t trading, it’s a high-stakes casino with better charts. They don’t believe in stop losses because “the market will come back.” Spoiler: it won’t. These traders often exit the industry dramatically, shouting “It’s all manipulated!” before trying the crypto markets instead.

4 - The Revenge Trader – “The Market Owes Me”

This person takes losing personally. After a bad trade, they don’t move on - they declare war. They increase lot size, change timeframes, open countertrades, and whisper to the chart, “You think you’re smarter than me?” The market, of course, always wins. They eventually leave forex, claiming, “I could’ve been great if I wanted to.”

5 - The Zen Monk (A Very Rare Species) – “It Is What It Is”

They accept losses, follow rules, and treat trading like a marathon, not a sprint. They do not have FOMO, they do not chase revenge, and they definitely do not scream at candles. These are the ones who actually make it - which is why they are rarely found in trading forums or on YouTube.

Why People Start Trading Forex: The Honest Truth

Reason

Internal Translation

Financial Freedom

“I don’t want a boss anymore.”

Work From Anywhere

“I want to trade from a beach… with Wi-Fi.”

Fast Money

“This looks easier than getting a degree.”

Intellectual Challenge

“I like puzzles… and pain.”

Ego & Status

“Imagine telling people I trade currencies…”

But while many enter the forex arena with dreams and determination, most don’t stay long. Why? Because they expected numbers and charts… but what they found was patience, discipline, emotional warfare, and a mirror reflecting their worst habits.

The Harsh Reality: Why So Many Traders Quit So Quickly

Many people enter forex trading with dreams of financial freedom. Few stay long enough to realise it’s less of a money-making sprint and more of a psychological endurance test. The harsh truth? Most traders don’t get blown out by the market - they get blown out by their own expectations.

Expectation vs Reality: The Forex Plot Twist

Expectation

“I’ll make £100 a day, easy.”

Reality

Loses £300 before breakfast.

New traders imagine smooth equity curves, patient entries, and dignified exits. In reality, they experience midnight chart checks, emotional rollercoasters, and shouting “MOVE!” at silent candles.

The Emotional Stages of a New Trader

1 - Excitement – “I’ve discovered the secret to wealth.”

2 - Confusion – “Why did price drop after I bought?”

3 - Denial – “It’s just a pullback… right?”

4 - Panic – “CLOSE IT. CLOSE IT NOW.”

5 - Blame – “The broker hit my stop on purpose. “Everyone blames the broker!

6 - Rebirth – Uninstalls platform. Reinstalls 2 hours later.

The First Blown Account: A Trader’s True Initiation

Everyone remembers their first blown account. It’s a tragic love story:

“I believed in those setups.”

“I was so sure this was the bottom.”

“Maybe I should’ve used a stop loss?” (Yes. Yes, you should’ve.)

After the emotional smoke clears, traders usually face three options:

Path Taken

What Happens Next

Quit Completely

Proclaims forex is a scam. Becomes crypto guru instead.

Blame Everything

Broker, spread, moon cycles, Mercury retrograde.

Return Wiser

Learns risk management. Accepts pain. Evolves.

Why So Many Quit

● They wanted money, not self-discipline.

● They expected certainty but met probability.

● They thought strategy is everything, but realised mindset is more.

Most traders don’t lose because they lack technical knowledge. They lose because they cannot control themselves. The hardest part of trading isn’t analysis - it’s resisting the button your finger is already hovering over.

The Psychology of Successful Traders

While most traders battle hope, fear, and impulse, a small group emerges from the chaos with something rare: consistency. These are the ones who no longer chase the market - they let the market come to them. How? By mastering themselves.

What Successful Traders Understand (That Most Don’t)

1 - Discipline Beats Genius

You don’t need a genius IQ to succeed in forex. But you do need the emotional control to follow your rules. A disciplined trader with a simple strategy will outperform an impulsive trader using the world’s most sophisticated system. Every. Single. Time.

“Great traders don’t predict – they prepare.”

2 - Patience Is a Superpower

Successful traders can stare at a chart for hours and do nothing, because doing nothing is often the most profitable move. Meanwhile, others enter trades because they’re bored - and the market punishes boredom with precision.

Trader Mindset

Result

“Something is happening, I must trade!”

Consistent losses.

“Nothing meets my criteria. I’ll wait.”

Long-term profitability.

3 - Acceptance of Loss

Winners don’t just tolerate losses - they expect them. They see losing trades as the cost of doing business, not personal failures. Losers chase revenge; winners move on and protect their capital.

“I didn’t lose. I paid for the lesson.”

4 - Emotional Clarity

They don’t marry trades. They don’t argue with charts. They don’t add to losing positions while whispering, “Come back… please…”. They set a plan, execute it, and detach.

Consistent Traders Think in Probabilities, Not Certainty

● Unsuccessful traders ask: “Will this trade win?”

● Successful traders ask: “Does this trade fit my rules?”

They know they don’t need to win every trade - they just need to stay in the game long enough for their edge to play out.

The Shift: From Profit-Chasing to Capital Preservation

● Early traders ask, “How much can I make?”

● Professional traders ask, “How much can I afford to risk?”

The day a trader learns to protect capital instead of chasing profit… their learning curve turns into a growth curve.

The Ego Battle: The Market Does Not Care About You

Let’s get this straight: the market has no personal vendetta against you. It didn’t spike 50 pips just to hit your stop loss. It doesn’t see your trendline, it doesn’t care about your feelings, and it certainly isn’t impressed by your “95% win rate strategy.”

But try telling that to a trader in revenge mode.

Overconfidence: The Silent Account Killer

After a few winning trades, traders often believe they have “cracked the code.” They start increasing lot sizes, ignoring their plan, and truly believing they cannot be wrong. Then one trade humbles them so hard they begin researching how to become a Monk!

Ego Says

Reality Says

“This setup can’t fail.”

It can. And it will.

“I’ll double my account today.”

You’ll halve it instead.

“I know it’s going up.”

You believe it’s going up. Big difference.

The Trap of Being ‘Right’ vs Being Profitable

Some traders care more about being right than making money. They hold onto losing trades because closing them would mean admitting defeat. They’d rather lose money than lose pride. Professionals? They close losers without flinching because they prioritise their account, not their ego.

“Be wrong and survive, rather than be right and blown out.”

Personalising the Market

New traders think the market is against them. They say things like:

● “It ALWAYS reverses when I enter.”

● “The market waits for me to close, then moves.”

● “These brokers know where my stop loss is!”

Truth bomb: The market doesn’t know who you are. It’s not hunting you; it’s hunting liquidity. But ego convinces traders otherwise - that they are the main character in a grand financial conspiracy.

Humility: The Real Trading Edge

The most profitable traders are strangely calm, even humble. They don’t boast. They don’t marry predictions. They trade quietly, like gardeners tending positions rather than warriors battling them.

Success in trading comes the day you stop trying to win against the market and start trying to work with it.

Emotional Traps: Fear, Greed & FOMO

Trading platforms should really come with a warning: “May cause wild emotional swings, self-doubt, and talking to your screen.” Even traders with perfect strategies often fall victim to powerful emotions, sabotaging themselves from within.

Fear – The Hesitant Assassin

Fear makes traders freeze when they should act, and panic when they should wait.

● Fear of entering:“What if it loses?” And so they miss perfect setups while waiting for a sign from the universe.

● Fear of holding: Price moves 5 pips in profit - “Take it before it turns!” Result? Tiny wins, massive losses.

● Fear of losing: Ironically causes bigger losses. The fearful trader refuses to close a bad trade, hoping it will “come back.” It doesn’t.

Greed – The Silent Saboteur

Greed doesn’t whisper - it shouts.

● “Let it run… I’m going to retire on this trade!”

● “Move the stop. Give it MORE room.”

● “Why close in profit when I can ride this to the moon?”

Greed convinces traders they’re about to catch a legendary move. Reality usually responds with full retracement.

Greedy Thought

Typical Outcome

“One more trade…”

Account: Help me.

“Double the lot size!”

Margin Call City

FOMO – Fear of Missing Obscenity

Ah, the deadliest of all. The “I must get in!” sickness. A candle flies, and logic dies.

FOMO traders enter late, buy tops, sell bottoms, and then ask, “Why does this always happen to me?”

They don’t want a good trade.They want to be in a trade.

This is why price almost always reverses right after they enter. Not because the market hates them… but because they chased the win and ditched the plan and any sound logic.

Emotional Trading vs Professional Trading

Emotional Trader

Professional Trader

Trades because of feeling

Trades because of setup

Chases candles

Waits like a sniper

Moves stops in hope

Moves stops in logic

Seeks excitement

Seeks consistency

The brutal truth? The biggest battle in forex isn’t against the market. It’s against ourselves, our impulses, and our desperate need to always be doing something.

Building a Winning Trading Mindset

Trading success doesn’t come from finding a magic indicator - it comes from mastering your own mind. A strong trading mindset transforms chaotic emotional reactions into calm, consistent decision-making. It’s the difference between blowing accounts and building them.

So how do the consistent traders do it?

1 - Trade with a Plan - or the Market Will Plan for You

A trading plan is your emotional shield. Without one, every candle becomes a personal attack.

A solid plan includes:

✔ Entry criteria

✔ Stop loss & take profit placement

✔ Risk per trade

✔ Maximum trades per day

✔ When to walk away

If you can’t write your plan down, you don’t have a strategy - you have impulses.

2 - Keep a Trading Journal (Yes, Really)

Most traders hate this step… (me included), and that’s exactly why it works.

Recording trades forces honesty:

● “Why did I enter?”

● “Did I follow rules?”

● “Was I rational or reckless?”

You can’t fix what you don’t track. Journaling turns mistakes into lessons instead of repeated disasters.

3 - Risk Small - Think Long

Professional traders rarely risk more than 1-2% per trade. Why? Because survival is the goal. They know:

“If you can’t survive a losing streak, you’ll never reach a winning one.”

● Amateurs ask: “How much can I make?”

● Professionals ask: “How much can I lose and still be fine?”

4 - Embrace Boredom

Real trading isn’t exciting. It's waiting. Watching. Drinking tea. Checking if the candle closed. Then waiting more.

Those who crave excitement over discipline eventually find excitement… in liquidation.

5 - Take Breaks – Clear Mind, Better Trades

A bad day in the markets isn’t fixed by another trade - it’s fixed by a walk, a reset, a break.

The winning mindset knows:

“The market will still be here tomorrow. My account might not be though.”

6 - Focus on Process, Not Daily Profit

Obsess over execution, not equity. Success is built on consistency, not luck.

Loser Focus:

“I must win today.”

Winner Focus:

“I must follow my plan today.”

Follow the plan long enough… and the profits eventually follow you.

In short: You don’t need more indicators. You need more self-control.

Conclusion: Master the Market by Mastering Yourself

In the quest for forex success, most traders search for the perfect strategy, the ultimate indicator, or the secret signal that promises endless profits. But eventually, all roads lead to the same truth:

The market isn’t your biggest opponent. You are.

Charts don’t care about your hopes. Candles don’t bend to your will. Economic news doesn’t wait for you to “just place one quick trade.” The forex market is indifferent, unemotional, and beautifully brutal - and that’s exactly why mastering trading psychology gives you the ultimate edge.

Success in trading isn’t found in prediction. It’s found in preparation, patience, and the ability to stay calm when everything inside you just wants to panic. It’s choosing logic over impulse, process over profit, and longevity over excitement.

Yes, there will always be losses. There will be days when the market humbles you, when setups fail, when candles sprint in the wrong direction. But the successful trader doesn’t fight the chaos - they flow with it. They take the loss, record it, breathe, and return the next day with clarity, not vengeance.

The Real Trader’s Journey

● First, you chase money.

● Then, you chase knowledge.

● Finally… you chase mastery of yourself.

And somewhere along that path, you stop needing to win every trade - because you finally understand how to win the game.

So, to every trader still battling fear, ego, revenge, and FOMO - remember this: you’re not alone. Every profitable trader you admire has been precisely where you are. The difference is… they didn’t quit.

They adapted. They grew. They mastered their mind - and the market followed.