How did it come to this? How did investment and finance come to occupy such a massive part of our modern world? Finance is now the backbone of entire countries. Every major city on Earth has a whole district dedicated to it. People build their careers and lives around it. How did it all start?

The first, modern instance of private investment is widely believed to date back to 16th century Amsterdam. Up until that point in time, mercantilism was the main driver of financial activity. People made money by buying, selling and transporting goods. Trade was the backbone of every economy in the world and it extended to the far corners of the globe. The activity was relatively accessible to all; merchants were common among most societies.

The same could not be said for investing, nor investors. The concept barely existed at the time. Like with most important steps in our societal evolution, we kind of fell into it to fill a need. As naval trading expeditions expanded further and further, a problem emerged: voyages to the other side of the world were extremely expensive and wrought with peril. Building, supplying and staffing a ship was a barrier to entry only the deepest pockets could overcome. To mitigate the risk, the Dutch came up with a pretty neat solution. Instead of a single entity footing the bill, the enterprise was divided into shares. Companies, banks and even individuals could all purchase as many or as few shares as their situation allowed. In the event of a successful journey, the profits were shared proportionally. And so it was that the modern investor was born. For the first time, people had the opportunity to financially participate in something much larger than themselves. Peasants and noblemen everywhere rejoiced.

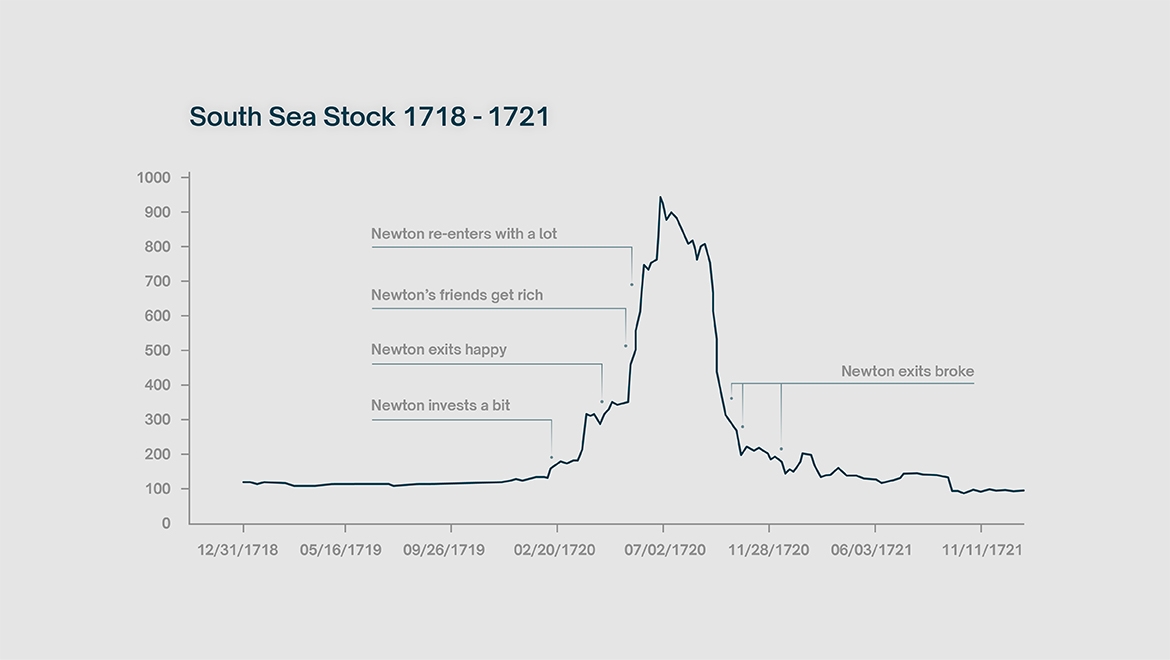

Little would change for the average investor over the next couple of centuries. Isaac Newton himself dabbled in stock trading. Genius he may have been but his short venture in the markets ended in tears. He bought a modest amount of South Sea stock in early 1720 before selling the position for a small profit a few months later. Shortly thereafter, the stock went parabolic and all his friends got rich, or so the story goes. Newton re-entered the market with a much larger position, just in time for the bubble to burst. He lost everything, sold at the bottom and was quoted as saying:"I can calculate the movement of the stars, but not the madness of men".FOMO is a harsh mistress.

A century more would pass before the idea of regular people investing their extra cash became commonplace. This era would beget modern investing, as well as some of the firms that still operate to this day: Goldman Sachs, Lehman Brothers and later JP Morgan to name a few. Average Joes could now waltz into a stock exchange with all the money they had carefully acquired throughout the week and lose it all within minutes based on the financial diligence of the shoeshine boy outside. What a time to be alive.

The first stock indices would also appear during this time. In 1884, the Railroad Average would start being published, reporting the top 12 stocks relating to railways, steel mills and mining companies. This index would later expand to 30 companies from a much wider range of industries, and eventually become the Dow Jones Industrial Average that we all know today.

The development of the hedge fund is the next important step in providing the man on the street with easier access to financial markets. Although the term was only coined in 1949, hedge funds themselves date back to the 1920s. The earliest hedge funds were only accessible to the wealthiest investors however and it would take several decades before they opened their doors to the plebs.

The massive economic growth that occurred after the Second World War coincided with the rise in mutual funds. This was the time when fortunes were made. By the 1960s, stock investing was all the rage, many remembering the period as the golden “go-go years” of investing. Mutual fund managers attained rock-star status, earning themselves massive salaries and commissions along the way. It was through these funds that the average investor accessed the stock market, guided by teams of so-called financial experts, advisors and people with more suits than sense. Cults of personality developed around the top fund managers; mania took hold of the markets; people would think nothing of dumping their entire pay check into stocks, sometimes electing to get paid in them directly.

Everyone is a genius in the bull market. By the 70s, it all went catastrophically wrong. Many funds saw losses of up to 50%; some didn’t survive at all, being merged, acquired and split into oblivion. For many, the space under the mattress had never looked so appealing. The dream was dead and it would take well over a decade to be revived. The lesson here, if there is one, is that the so-called financial experts thrived only as long as the underlying markets did.

The story continues in part II.

Amaran Risiko : Perdagangan derivatif dan produk berleveraj mempunyai tahap risiko yang tinggi.

BUKA AKAUN