In 1986, The Economist magazine began publishing the Big Mac Index, a price index illustrating the relative difference in price of its namesake McDonald’s burger in different parts of the world. The purpose was simple: to offer a digestible way of comparing the purchasing power parity (PPP) between different currencies. Despite starting out as a bit of a joke, the index has gained significant gravitas in the world of economics, becoming not only a recognised financial metric, but one that has been subject to political manipulation, adding another dimension to the phrase “cooking the books”.

PURPOSE

Gastronomic puns aside, the intended purpose of the Big Mac Index was a noble one. PPP is relatively simple to calculate on paper; after all, it is nothing more than the price ratio of the same good in different countries. For example, if a brick costs £2 in the UK and $3 in the US, then the PPP for bricks between the UK and the US would be 1.5 Dollars to the Pound. In fact, some traders compare this value to the actual exchange rate to see if a certain currency is overvalued.

The problem is that PPP does not rely on one price alone, but on that of a vast array of goods and services, making the collection and parsing of such data somewhat difficult. It includes thousands of price points from commercial, governmental and infrastructural sectors. The elegance of the Bic Mac Index is that such prices are already baked in (final pun I promise). After all, the price of a Big Mac already factors in a huge number of variables. Agricultural prices include many costs, including land, fertiliser, bribing politicians, labour and transport; we then have to include processing, further freight costs, construction, paying unmotivated employees as well as all the usual burdens of doing business.

The Big Mac Index was successful enough that it prompted the creation of several other equally humorous indices, including the IKEA Bookshelf Index and the Chai Latte Global Index, to the amusement of bored economists everywhere.

DRAWBACKS

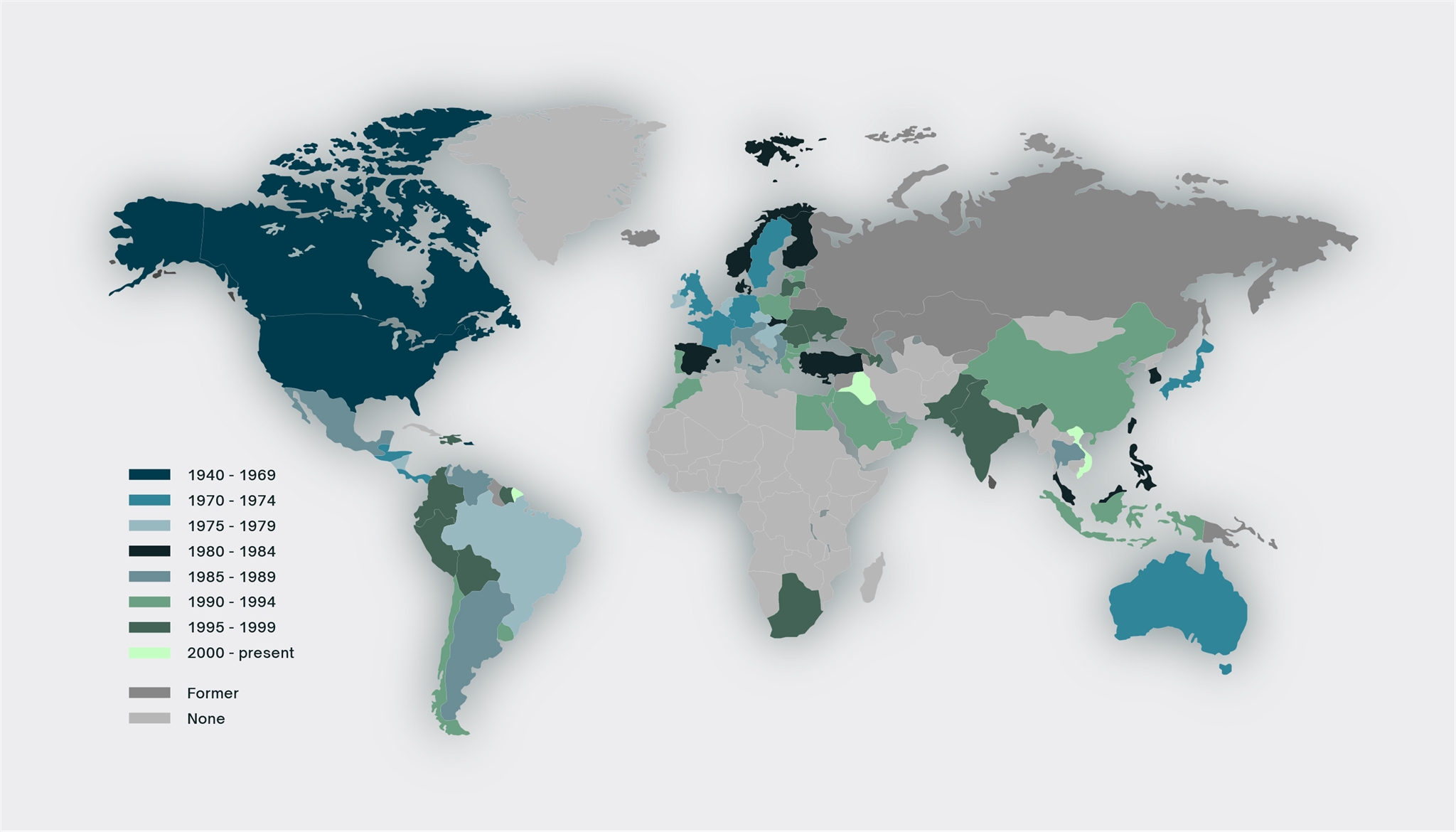

Shockingly, an economic tool first designed as a joke presents some limitations. The first is that the golden arches of culinary excellence haven’t yet reached some parts of the world:

Out of the entire African continent, only Morocco, Egypt, South Africa and Mauritius have received Ronald McDonald’s blessing. The situation in Central Asia is also somewhat bleak. Fortunately for Africa, the KFC Index also exists, this time the 12-piece bucket taking the mantle of financial barometer.

Geographical problems extend to local differences in pricing. A Big Mac in London costs more than the same item in Liverpool, despite being in the same country. The Eurozone further exacerbates this issue, the same meal varying widely in cost between Belgium and Portugal for example, despite using the same currency.

Local taxes, wages and costs of living all have significant impacts on food prices. Market dynamics play a heavy hand in the pricing of any good, which is why PPP differs from currency exchange rates in the first place. Moreover, some populations are simply unwilling to pay the same amount for the same good as others, despite having a very similar purchasing power. McDonald’s is more popular in some countries than others. More relevantly, the Big Mac itself is a more or less popular item depending on where you are in the world.

CONTROVERY

Given that the Big Mac Index is dependant on a sole item, it follows that manipulating such an index would be relatively easy. This is what is widely believed to have occurred in Argentina. In an effort to hide rampant inflation in the South American economy, it seems the price of the Big Mac was artificially supressed compared to other items on the menu. For several years the Big Mac was unusually cheap and yet McDonald’s stores made no effort to advertise it. The Economist themselves weighed in on the controversy, stating “The gap between its average annual rate of burger inflation (19%) and its official rate (10%) is far bigger than in any other country”. The blame for such manipulation was levelled against Guillermo Moreno, Secretary of Commerce at the time. Eventually, the price of the Big Mac suddenly shot up 26% in line with other burgers. El Cronista, a daily business newspaper published in Buenos Aires, covered the story with the headline “Moreno loses the battle: the Big Mac comes out of the freezer and increases its price by 26%”. The food puns are too tasty to resist.

Risk Warning : Trading derivatives and leveraged products carries a high level of risk.

OPEN ACCOUNT