Trading the financial markets is a bit like choosing your favourite fairground ride. Some people love the bumper cars of forex where it is quick, chaotic, and full of unexpected collisions. Others prefer the rollercoaster of indices, a lot smoother most of the time, but with the occasional sharp drop that leaves your stomach twisted in knots.

What exactly are indices, and why do traders bother with them? Well, an index (plural: indices, not “indexes”) is essentially a basket of stocks grouped together to give us a snapshot of how a market, sector, or economy is doing. Think of it as the “Netflix Top 10” for financial markets; instead of telling you which shows everyone’s binging, it shows you which companies are making investors happy (or crying).

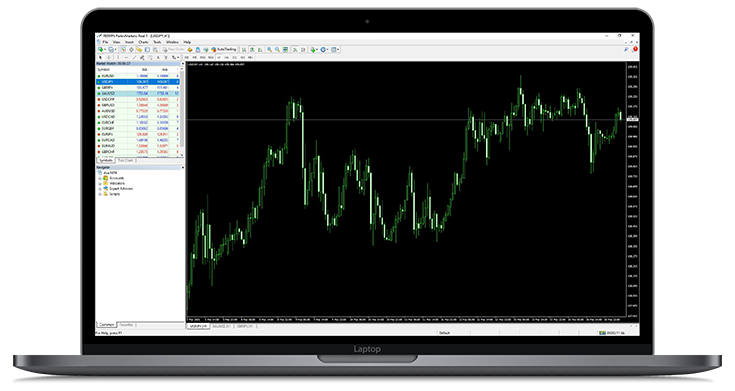

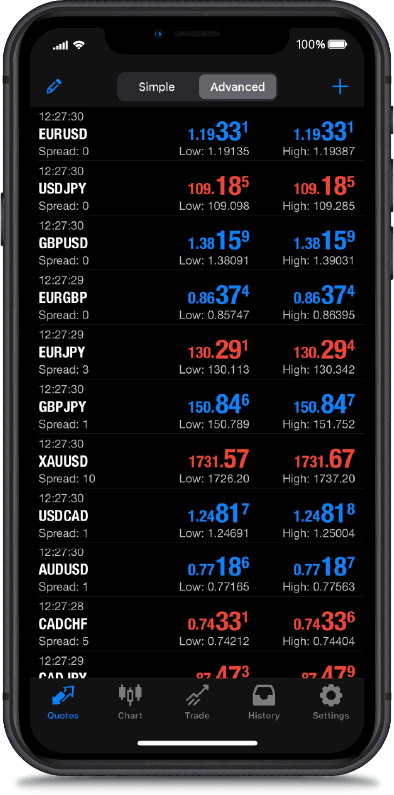

But here’s the kicker: indices aren’t just for economists wearing geeky glasses or Wall Street traders with ten cups of coffee in their system. Thanks to modern brokerages, everyday traders can speculate on the rise and fall of entire economies without having to pick individual stocks. It’s like betting on the whole football league instead of trying to guess whether your team will turn up and play well on match day.

In this article, we’re going to break down what indices actually are, how they’re categorized, what makes their prices move, and why some traders love them, while others swear by forex. We’ll also look at the drama that sends these markets up and down, because let’s face it, if you can’t laugh at central bank press conferences, you’ll end up crying into your economic calendar.

What Are Indices?

Let’s start with the basics: an index (plural “indices” if you want to impress your fellow traders, or “indexes” if you’re in the U.S. and don’t care) is essentially a scoreboard for a group of stocks. Instead of tracking one single company, like Apple or Amazon, an index bundles a collection of them together to give you a big-picture view of how a market or sector is performing.

Some of the most famous indices include:

●

The S&P 500 – tracks 500 of the largest publicly traded companies in the U.S. If the S&P 500 sneezes, Wall Street usually catches a cold.

●

The Dow Jones Industrial Average (DJIA, WS30, US30) – one of the oldest indices markets, with just 30 companies including McDonalds, Microsoft, Visa and Walmart.

●

The FTSE 100 – the top 100 companies listed on the London Stock Exchange. Heavily influenced by oil and mining, so when commodity prices wobble, so does the FTSE.

●

The DAX – Germany’s top 40 companies, often seen as Europe’s economic bellwether. Companies include Adidas, BMW and Airbus.

●

The Nikkei 225 – Japan’s big one, reflecting its powerhouse corporations like Panasonic, Toyota, and Nintendo (yes, even Mario has a stake in this).

In short, indices give traders an easy way to measure and trade the performance of entire markets, without needing a spreadsheet big enough to track hundreds of individual stocks. And thanks to brokerages offering CFDs, ETFs, and futures, you don’t need to be a Wall Street insider to jump on board.

How Indices Are Categorized

Just like streaming services sort movies into “Action,” “Horror,” and “You may also like….,” indices are grouped into categories too. This makes them easier to follow and helps traders figure out which flavour of chaos they want to trade. Here are the main ways indices are organized:

1. Market Capitalization Weighted

This is the most common type. Companies with bigger market values (price × number of shares) carry more weight in the index. The S&P 500 is a classic example. Giants like Apple, Microsoft, and Amazon have so much influence that if they trip over their own shoelaces, the entire index grazes their knees.

2. Price Weighted

This one makes less sense on paper but has survived tradition. The Dow Jones Industrial Average (DJIA) is price-weighted, meaning a company’s stock price determines its influence, not its size. So, a company with a higher share price can disproportionately move the index, even if it’s smaller overall. It’s kind of like letting the person with the loudest voice run the meeting, regardless of whether or not they know what they’re talking about.

3. Equal Weighted

Here, each company has the same influence on the index, no matter how big or small it is. Equal-weight indices give the little guys some power, which is great, but also means the overall performance may look very different compared to their heavier weighted cousins.

4. Sector-Based Indices

These track specific industries, like tech, energy, or healthcare. If you’re convinced renewable energy is the next big thing, you can trade an energy index. If you’re sure everyone will still need pills and doctors in 50 years (safe bet), there’s a healthcare index for that.

5. Regional and Global Indices

Some indices represent national markets (FTSE 100 for the UK, DAX for Germany), while others combine multiple markets. For example, the MSCI World Index bundles companies from around the globe.

The way an index is categorized affects how it moves and how much influence individual companies or sectors can have. A cap-weighted index like the S&P 500 can rise or fall on the back of just a few mega-cap companies, while a sector-based index might spike if one industry suddenly gets hot (or crash when it isn’t).

Before you decide to trade an index, it’s worth checking how it’s built; otherwise, you might be expecting a gentle stroll in the park and find yourself running a marathon.

What Moves the Indices markets?

If indices are the “Greatest Hits Compilation Albums” of the financial world, then what makes the tracks go up or down in the charts? The truth is that indices are moody creatures. They don’t just react to one thing: they’re influenced by an array of events, from economic reports to company gossip. Let’s look at the usual suspects:

1. Economic News & Investor Sentiment

Economic announcements are like plot twists in a movie, everybody reacts, often dramatically. Inflation figures, GDP growth, unemployment data, and especially central bank announcements (shout out to the Federal Reserve) can send indices swinging.

The Non-Farm Payroll (NFP) report in the U.S. is a classic: released once a month, it can make markets dance like your dad after a few too many. If the numbers surprise traders, you’ll see sudden spikes in volatility across indices like the S&P 500 and Dow.

Investor sentiment also plays a huge role. If the mood is optimistic, indices climb. If traders panic, they tumble. Sometimes it doesn’t even matter if the news is objectively “good” or “bad”. What matters is how investors feel about it. It’s basically the financial version of an AA meeting.

2. Company Financial Results

When companies that make up an index release earnings reports, their share prices move, and the index moves with them. This is especially true in weighted indices, where the big players like Apple, Microsoft, or Tesla can drag the whole index up or down on their own.

3. Company Announcements

Changes in company leadership, mergers, acquisitions, or scandals all ripple through indices. A new CEO could inspire confidence and push share prices higher, or they could tank the stock faster than you can say “Twitter rebrand.” Think back to the recent Elon Musk Department of Government Efficiency (DOGE) saga, Tesla’s share price went into freefall and in the end, Musk stepped away from his government appointed role.

These announcements are often unpredictable, and that unpredictability is what traders live (and occasionally cry) for.

4. Changes to Index Composition

Indices aren’t static, they are updated to reflect the changing market. Companies can be added or removed depending on their performance. When a company joins an index, demand for its shares often spikes because funds tracking the index need to buy in. When one is booted out, well, it’s like being voted out of the exclusive club, demand collapses.

Traders anticipate these changes, which means prices often shift dramatically around rebalancing periods. It’s the financial equivalent of musical chairs.

5. Commodity Prices

Some indices are heavily tied to commodities. The FTSE 100, for example, has about 15% of its companies in the oil and mining sectors. If oil prices tank, the FTSE often follows. Germany’s DAX, meanwhile, is sensitive to energy and manufacturing costs, while Japan’s Nikkei gets rattled by shifts in energy imports.

In other words, commodities act like background music for indices: you might not notice it at first, but it sets the mood for everything else.

So, whether it is central bankers mumbling about interest rates, Apple announcing record iPhone sales, or oil prices spiking because of unrest in an oil-producing region, indices will react. Sometimes violently. Sometimes irrationally. But always in a way that keeps traders glued to their screens and their coffee pots.

Indices vs Forex: The Face-Off

Advantages of Trading Indices

1. Built-In Diversification

● Indices give exposure to multiple companies at once. If one stock stumbles, others may cushion the fall.

● Forex? You’re betting on single currency pairs, so swings can be sudden and brutal.

2. Clear Influences

● Economic reports, corporate earnings, and commodities often give a logical explanation for movements.

● Forex moves can feel like guessing which way a cat will jump—central bank interventions, geopolitical tensions, or even a single politician’s offhand comment can move the market.

3. Less Chaotic During Off-Hours

● Many indices have defined trading hours and lower volatility outside these periods.

● Forex trades 24/5, meaning someone, somewhere, is always moving the market. Sleep? What sleep?

4. Theme-Based Opportunities

● Indices let you trade broad economic or sectoral themes: tech boom, energy crisis, etc.

● Forex themes exist too, but it’s more abstract: “risk-on” vs “risk-off” days, and nobody ever explains why.

Disadvantages of Trading Indices (vs Forex)

1. Limited Trading Hours

● Some indices don’t trade 24/5, so you can miss opportunities.

● Forex never sleeps (well, except over the weekend).

2. Lower Leverage

● Brokerages often limit leverage on indices compared to currency pairs.

● In forex, small moves can be amplified spectacularly good or bad.

3. Big Companies Can Dominate

● Weighted indices can be skewed by a handful of giants.

● Forex doesn’t have a single “company” that can tank a pair.

4. Margins Can Be Higher

● Trading indices may require bigger capital than forex positions.

Advantages of Trading Forex

● 24/5 market – trade whenever you like.

● High liquidity – EUR/USD alone trades more daily than most indices combined.

● High leverage – a small move can make a huge profit (or loss).

● Macro-driven – easier to focus on economic trends rather than individual company drama.

Disadvantages of Forex

● Extreme volatility – sudden swings can wipe out your account.

● Central bank interventions – governments can surprise traders.

● Fewer thematic trades – it’s harder to “ride a tech boom” here.

● Political shocks – tariffs, elections, wars, speeches—all can move currencies fast.

Bottom Line

Forex is like playing ping-pong with central bankers: fast, unpredictable, and sometimes ruthless. Indices are more like following a football league: exciting, with clear favourites, dramatic underdogs, and occasional surprises.

Risks & Rewards of Trading Indices

Trading indices can be fun but occasionally make you question your life choices. But is it a ride worth taking? Understanding the risks and rewards beforehand makes the experience a lot more enjoyable.

1. The Rewards

Diversification:

● Trading indices spreads your exposure across multiple companies. If one stock stumbles, others can soften the blow. This built-in diversification can make indices more stable than individual stocks, especially during earnings season.

Liquidity:

● Popular indices like the S&P 500, Dow Jones, and FTSE 100 are highly liquid. You can enter and exit trades easily without worrying about “no buyers” or “phantom sellers.”

Potential for Steady Growth:

● Over the long term, major indices tend to rise with the economy. While there are dips and crashes, long-term traders can benefit from gradual upward trends.

Clear Market Signals:

● Because indices represent broader markets, it’s often easier to spot trends than with single stocks. Technical analysis and economic indicators can give a better sense of where the market is headed.

2. The Risks

Volatility:

● Indices can swing dramatically during economic news releases, geopolitical events, or company-specific shocks. Even diversified indices aren’t immune to wild market moves.

Leverage Risks:

● Trading through CFDs or futures often involves leverage. While this amplifies gains, it also magnifies losses. One bad trade can wipe out weeks—or months—of careful gains.

Emotional Rollercoaster:

● Watching an index drop 2% while your positions are open can feel like stomach-churning horror. Traders need discipline, stop-losses, and perhaps a strong coffee or two.

Market Influences Beyond Your Control:

● Central bank decisions, sudden geopolitical tensions, or commodity price shocks can move indices in unexpected ways. Even the best analysis can’t predict everything.

3. And Finally…..

Trading indices offers a balance between the thrill of individual stocks and the broad stability of diversified portfolios. For those who enjoy strategic thinking, technical analysis, and staying on top of economic news, indices can be a rewarding playground.

But remember even the most stable indices will have their wild days. Always trade responsibly, use proper risk management, and don’t forget, sometimes it’s perfectly fine to step back, breathe, and remind yourself that the market doesn’t care about you or your feelings.