NHÀ MÔI GIỚI GIAO

DỊCH HÀNG ĐẦU

DỊCH HÀNG ĐẦU

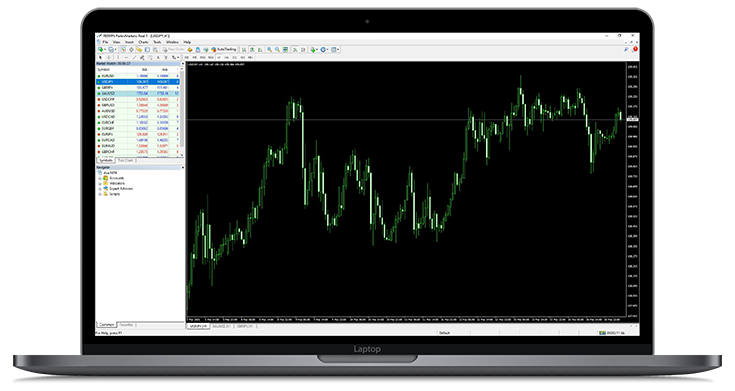

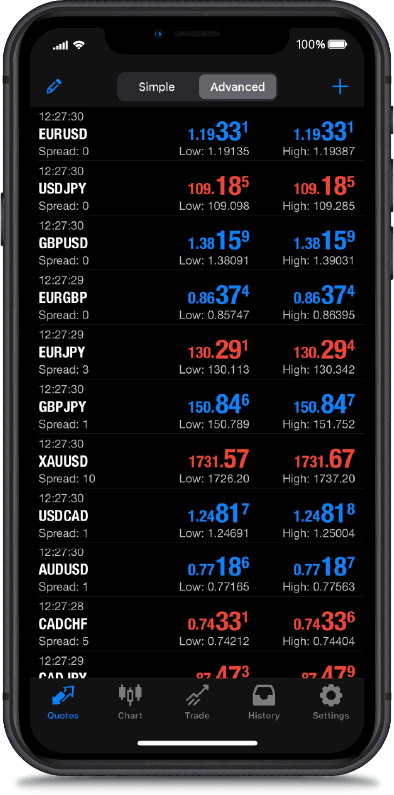

Truy cập hơn 350 sản phẩm bao gồm Ngoại hối, Cổ phiếu, CFD, Hàng hóa, Chỉ số và Kim loại với nền tảng MetaTrader 4/5.

CHÊNH LỆCH TRỰC TIẾP

EUR / USD

SPREAD

0.00

MUA

-----

BÁN

-----

XAU / USD

SPREAD

0.90

MUA

-----

BÁN

-----

EUR / JPY

SPREAD

0.10

MUA

-----

BÁN

-----

USD / JPY

SPREAD

0.00

MUA

-----

BÁN

-----

GBP / USD

SPREAD

0.20

MUA

-----

BÁN

-----

Giá trực tiếp chỉ mang tính chất tham khảo.

STANDARD

Không mất phí giao dịch

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Số tiền gửi tối thiểu $100

- Đòn bẩy tối đa 1 : 500

RAW

Phí giao dịch thấp

$2.5/mỗi chiều

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Số tiền gửi tối thiểu $100

- Đòn bẩy tối đa 1 : 500

LOẠI TÀI KHOẢN

PHÙ HỢP NHẤT VỚI BẠN

PHÙ HỢP NHẤT VỚI BẠN

Tại RADEPromoToggleWrapPX MARKETS, chúng tôi cam kết cung cấp cơ cấu giao dịch và thực hiện cạnh tranh.

TĂNG CƯỜNG HÀNH TRÌNH GIAO DỊCH CỦA BẠN CÙNG CHÚNG TÔI

Trải nghiệm giao dịch hoàn toàn mới với những tính năng tối ưu của chúng tôi. Nền tảng của chúng tôi không chỉ mượt mà mà còn thân thiện và tiện lợi, giúp bạn dễ dàng điều hướng trên thị trường một cách nhẹ nhàng và chuyên nghiệp.